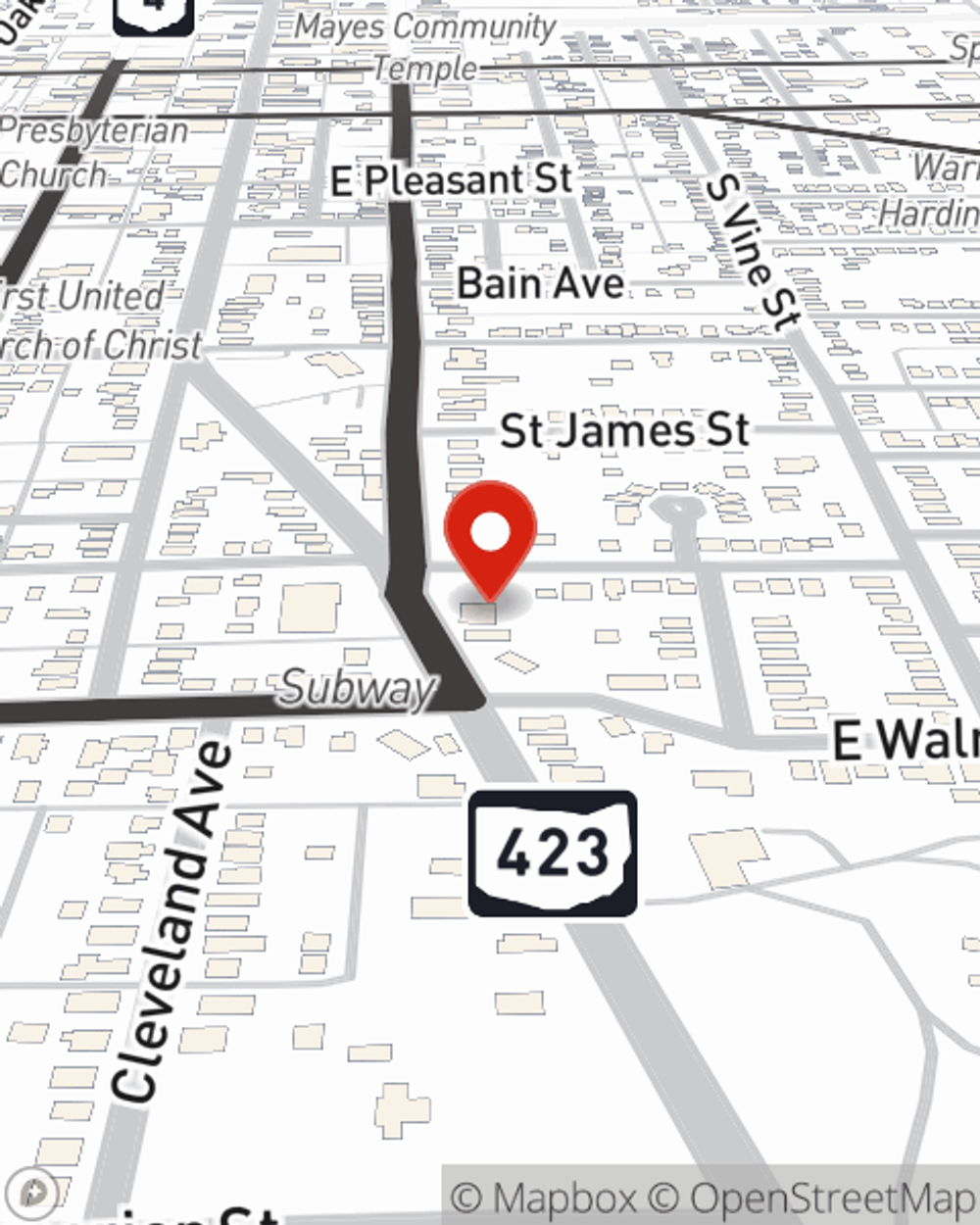

Renters Insurance in and around Marion

Get renters insurance in Marion

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

- Marion

- Delaware

- Lima

- Upper Sandusky

- Marysville

- Galena

- Dublin

- Powell

- Mansfield

- Columbus

- New Albany

- Sunbury

- Springfield

- Bellefontaine

- Ohio

- Tiffin

- Findlay

- Westerville

- Upper Arlington

- Kenton

- Ashland

- Worthington

There’s No Place Like Home

No matter what you're considering as you rent a home - size, internet access, furnishings, house or condo - getting the right insurance can be valuable in the event of the unpredictable.

Get renters insurance in Marion

Renting a home? Insure what you own.

Open The Door To Renters Insurance With State Farm

The unanticipated happens. Unfortunately, the stuff in your rented townhome, such as a desk, a laptop and a coffee maker, aren't immune to tornado or vandalism. Your good neighbor, agent Dan Barth, is ready to help you evaluate your risks and find the right insurance options to protect your belongings.

It's never a bad idea to make sure you're prepared. Visit State Farm agent Dan Barth for help learning more about savings options for your rented property.

Have More Questions About Renters Insurance?

Call Dan at (740) 387-3261 or visit our FAQ page.

Simple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Getting rid of dust in your house

Getting rid of dust in your house

A dusty home can make asthma and allergy sufferers uncomfortable. Discover tips to help reduce or eliminate the amount of dust in your house.

Simple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Getting rid of dust in your house

Getting rid of dust in your house

A dusty home can make asthma and allergy sufferers uncomfortable. Discover tips to help reduce or eliminate the amount of dust in your house.