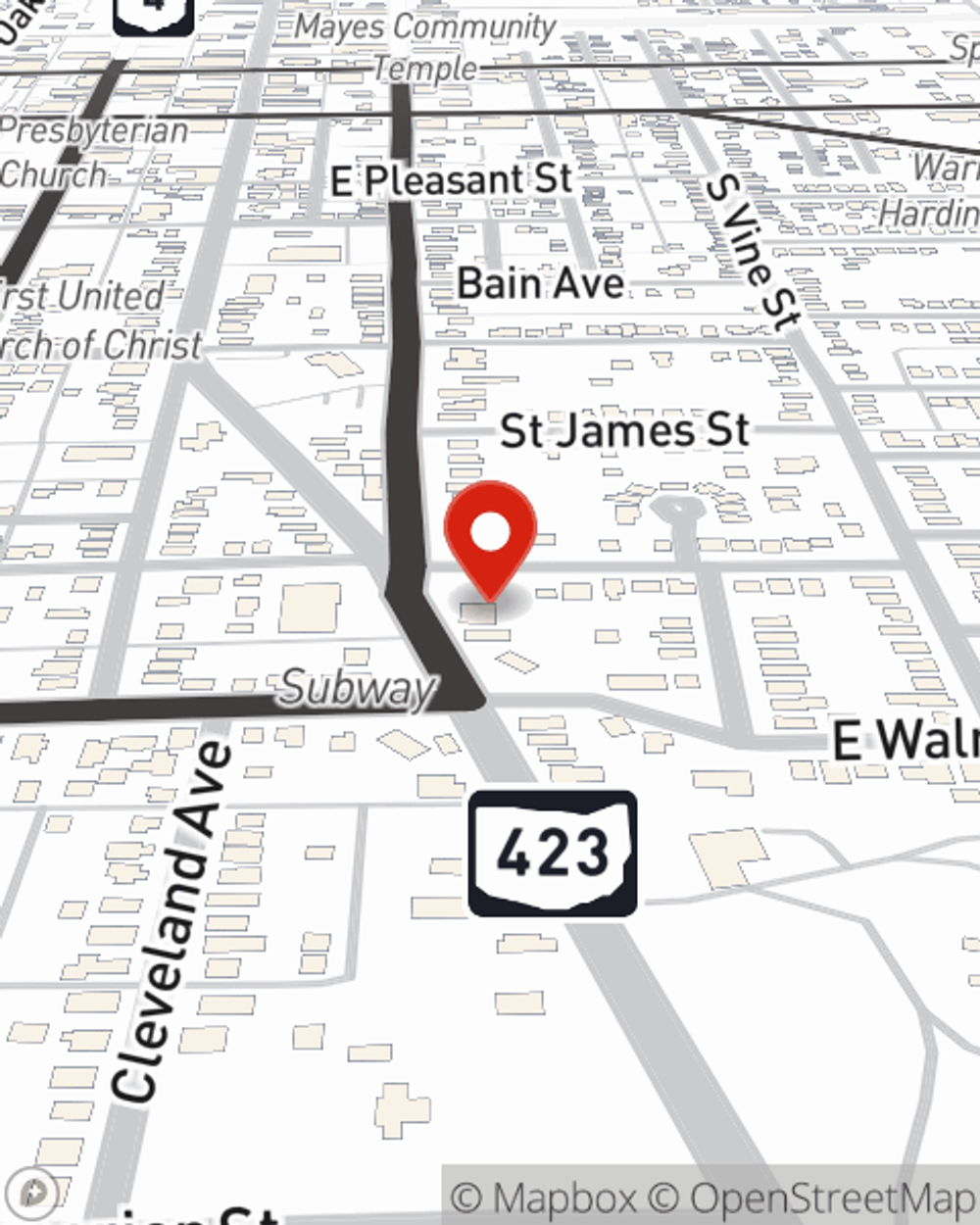

Business Insurance in and around Marion

One of the top small business insurance companies in Marion, and beyond.

Almost 100 years of helping small businesses

- Marion

- Delaware

- Lima

- Upper Sandusky

- Marysville

- Galena

- Dublin

- Powell

- Mansfield

- Columbus

- New Albany

- Sunbury

- Springfield

- Bellefontaine

- Ohio

- Tiffin

- Findlay

- Westerville

- Upper Arlington

- Kenton

- Ashland

- Worthington

Your Search For Remarkable Small Business Insurance Ends Now.

It takes courage to start your own business, and it also takes courage to admit when you might need guidance. State Farm is here to help with your business insurance needs. With options like business continuity plans, errors and omissions liability and a surety or fidelity bond, you can feel confident that your small business is properly protected.

One of the top small business insurance companies in Marion, and beyond.

Almost 100 years of helping small businesses

Protect Your Future With State Farm

Whether you own a cosmetic store, a home cleaning service or a pizza parlor, State Farm is here to help. Aside from outstanding service all around, you can personalize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

Call Dan Barth today, and let's get down to business.

Simple Insights®

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

Dan Barth

State Farm® Insurance AgentSimple Insights®

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".